Getting your first car is exciting. New drivers have a lot to learn. One important thing is car insurance. Insurance helps if something goes wrong. But, it can be costly. This guide helps new drivers find affordable car insurance.

What is Car Insurance?

Car insurance is a promise. You pay a company. They help if you have an accident. It covers costs like damage or injury. Having insurance is important. It is also the law in many places. Without it, you can get in trouble.

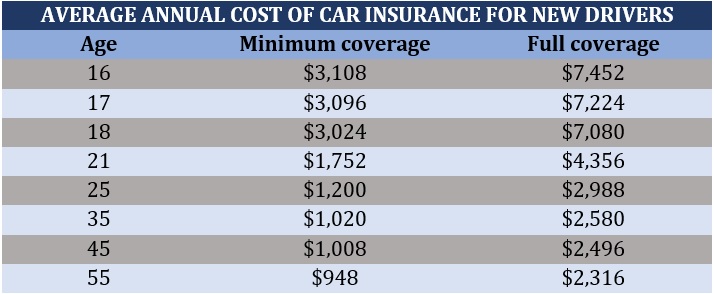

Why Do New Drivers Pay More?

New drivers often pay more for insurance. Why? They are new and less experienced. They might not know all the rules. Insurance companies see them as a risk. This means higher prices. But don’t worry. You can find ways to pay less.

Ways to Save Money on Car Insurance

There are many ways to save money. Let’s explore some good ideas.

1. Compare Different Companies

Look at many insurance companies. Each one has different prices. Find the best deal for you. This can save you a lot of money.

2. Choose The Right Car

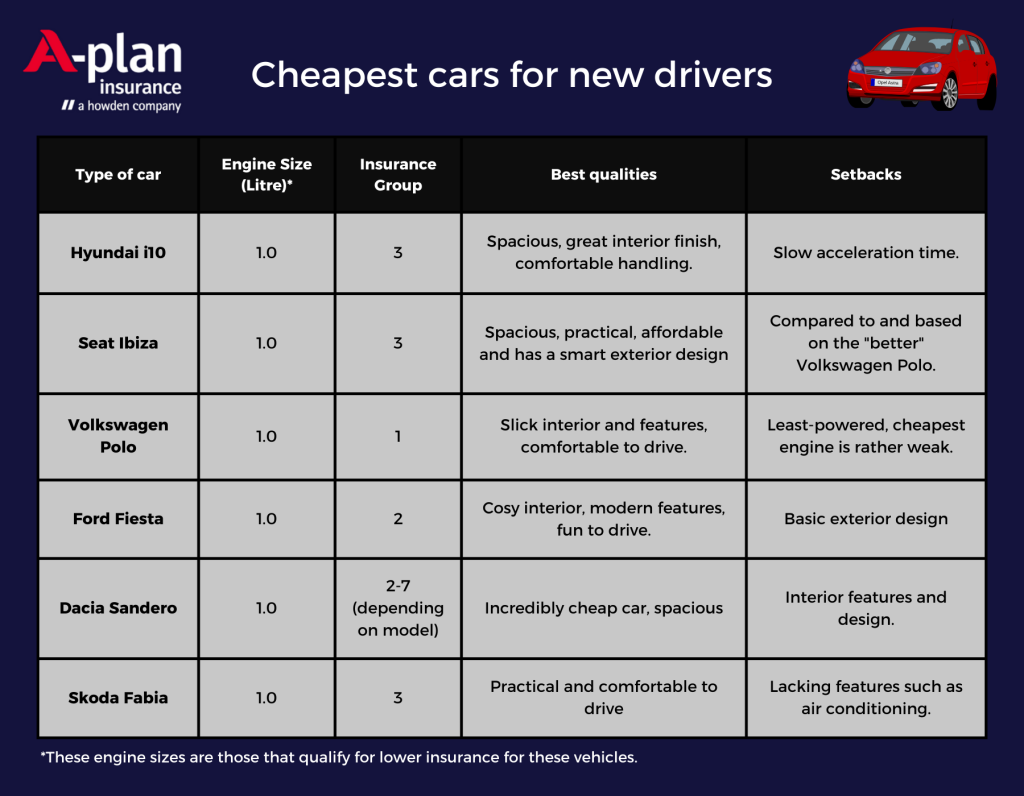

Some cars are cheaper to insure. Smaller cars often cost less. Cars with safety features can also save money. Think about this when buying a car.

3. Take A Driving Course

Safe driving courses help a lot. They teach you to drive better. Insurance companies like safe drivers. They might give you a discount.

4. Ask About Discounts

Many companies offer discounts. Ask about student discounts. Some companies offer good grades discounts. There are also discounts for safe driving.

5. Increase Your Deductible

Your deductible is what you pay if something happens. A higher deductible means lower insurance costs. Be careful. Make sure you can pay the deductible if needed.

Understanding Different Types of Coverage

Insurance has different parts. Knowing them helps you choose wisely.

| Type of Coverage | Description |

|---|---|

| Liability | Pays if you cause an accident. Covers damage to others. |

| Collision | Pays for damage to your car. Covers accidents. |

| Comprehensive | Covers damage from non-accidents. Things like theft or weather. |

| Personal Injury Protection | Covers medical bills. Pays for injuries to you or passengers. |

| Uninsured Motorist | Covers you if the other driver doesn’t have insurance. |

Tips for New Drivers

Driving is a big responsibility. New drivers should remember a few tips.

Drive Safely

Always follow the rules. Keep your eyes on the road. Don’t use your phone while driving. Safe driving keeps you safe and can lower your insurance.

Maintain Your Car

Take care of your car. Regular maintenance is important. Check your tires and brakes. A well-kept car is safer.

Avoid Traffic Violations

Speeding tickets can increase insurance costs. Follow speed limits and road signs. Avoid fines and keep your insurance low.

Frequently Asked Questions

How Can New Drivers Get Cheap Car Insurance?

Start by comparing quotes from different providers. Choose a car with safety features. Ask about discounts.

What Discounts Are Available For New Drivers?

Look for safe driver discounts. Some insurers offer savings for good grades or defensive driving courses.

Why Is Car Insurance Expensive For New Drivers?

New drivers lack experience. Insurers see them as higher risk. Higher risk means higher premiums.

How Does The Car Type Affect Insurance Cost?

Cars with high safety ratings often cost less to insure. Sports cars or luxury models may cost more.

Conclusion

Finding affordable car insurance is possible. New drivers should compare companies. Choose the right car. Take driving courses and ask for discounts. Understand different types of coverage. Drive safely and maintain your car. These steps can help you save money. Start today and enjoy driving!