Do you own a car? Then you need auto insurance. But finding the right insurance can be hard. You want to save money. You want to stay safe. How do you do both?

Why Compare Auto Insurance Rates?

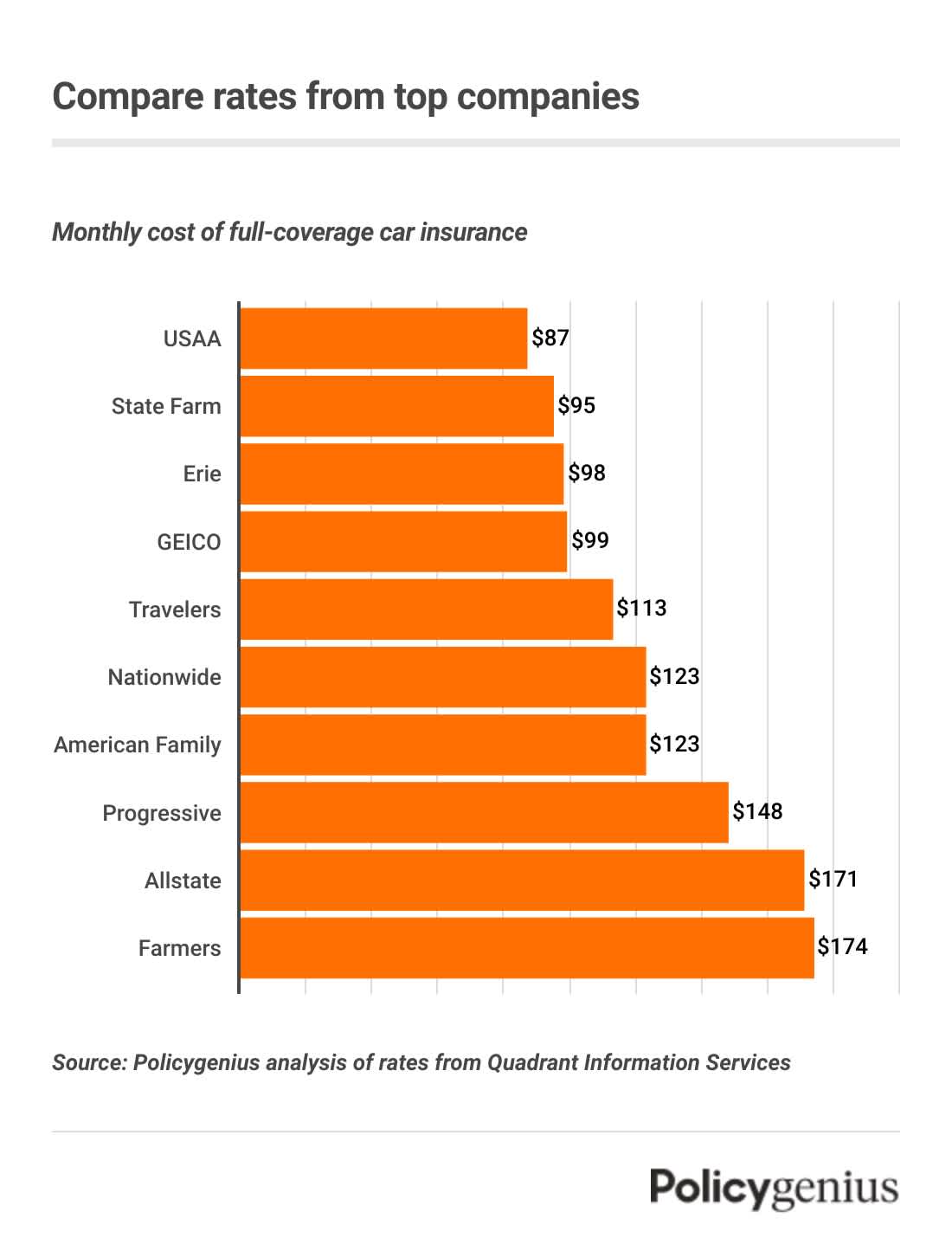

Insurance rates are different. They change from company to company. Some are high. Some are low. Comparing rates can help you find the best deal.

Save Money

When you compare rates, you can save money. Paying less for the same coverage is smart. You keep more money in your pocket.

Find Better Coverage

Good coverage means you are safe. When you compare, you find better plans. You get the protection you need.

How to Compare Auto Insurance Rates

Comparing rates is easy. Follow these steps to find the best insurance.

Step 1: Gather Information

Get your car details. Know your driving history. This info helps you get accurate quotes.

Step 2: Use Online Tools

Many websites help you compare rates. Use them. They are fast and easy.

Step 3: Check The Coverage

Look at what each plan covers. Some plans offer more. Some plans offer less. Choose what fits your needs.

Step 4: Read Reviews

See what others say. Reviews tell you if a company is good. They tell you if a company is bad.

Step 5: Contact Companies

Talk to insurance agents. Ask questions. Get clear answers. This helps you make the best choice.

Factors Affecting Auto Insurance Rates

Why do rates vary? Many factors affect insurance costs. Let’s look at them.

| Factor | Impact on Rates |

|---|---|

| Age | Young drivers pay more. |

| Driving Record | Accidents raise rates. |

| Car Type | Luxury cars cost more. |

| Location | City drivers pay more. |

| Credit Score | Low scores increase rates. |

Tips to Lower Auto Insurance Rates

Everyone wants cheaper insurance. Here are some tips to lower your rates.

Drive Safely

Safe driving keeps your record clean. Clean records mean lower rates.

Choose A Safe Car

Cars with safety features cost less to insure. Choose wisely.

Bundle Policies

Get home and auto insurance from one company. This often leads to discounts.

Improve Your Credit Score

Better scores can lower your rates. Pay bills on time. It helps.

Ask For Discounts

Some companies offer special discounts. Ask about them. Take advantage of offers.

Common Types of Auto Insurance Coverage

Insurance has different types. Know them. Choose what you need.

- Liability Coverage: Covers damages to others.

- Collision Coverage: Covers damages to your car.

- Comprehensive Coverage: Covers theft and natural disasters.

- Personal Injury Protection: Covers medical expenses.

- Uninsured Motorist Coverage: Protects if the other driver has no insurance.

Frequently Asked Questions

How Do I Find Cheap Auto Insurance Rates?

Compare quotes from different providers. Use online tools. Look for discounts. Review your coverage needs.

What Factors Affect Auto Insurance Rates?

Driving record. Age. Location. Type of vehicle. Coverage options. These all impact your rates.

Is It Better To Compare Auto Insurance Online?

Yes, it’s faster and easier. You can compare multiple companies. Access more options. Save time and money.

How Often Should I Compare Auto Insurance Rates?

Every six months. Or before renewing your policy. Rates change often. Regular checks ensure you get the best deal.

Conclusion

Comparing auto insurance rates is smart. It helps you save money. It helps you find better coverage. Use online tools. Read reviews. Contact companies. Choose the best plan for you. Stay safe and save money!