Looking for full coverage auto insurance near you? You are in the right place. We will help you understand what it is. We will show you why you need it. And guide you on how to find it.

What is Full Coverage Auto Insurance?

Full coverage auto insurance is a type of car insurance. It protects your car in many ways. It is not just one type of insurance. It includes several types.

- Liability Insurance: Pays for damage you cause to others.

- Collision Insurance: Covers damage to your car from a crash.

- Comprehensive Insurance: Covers damage from things other than crashes.

Why Do You Need Full Coverage?

Accidents can happen anytime. They can be very costly. Full coverage helps you pay for repairs. It also covers medical bills. And it helps you pay if you are sued.

If your car is new, full coverage is a good idea. It protects your investment. Without it, you may have to pay a lot out of pocket.

How to Find Full Coverage Auto Insurance Near You

Finding full coverage auto insurance is easy. Here are some simple steps:

- Search online for insurance companies near you.

- Visit their websites.

- Check what types of coverage they offer.

- Compare their prices and benefits.

- Read reviews from other customers.

You can also talk to friends and family. They may know good insurance companies. You can ask them for advice.

What to Consider When Choosing Full Coverage

When choosing full coverage, think about these things:

- Your Budget: How much can you afford to pay?

- Coverage Needs: Do you need more than basic coverage?

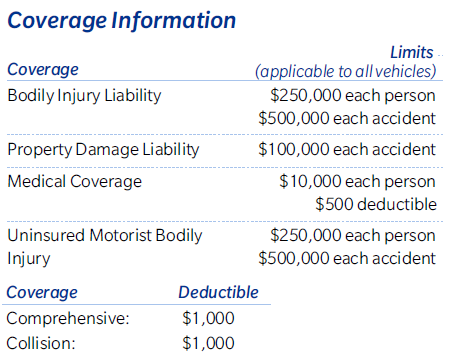

- Deductibles: How much will you pay before insurance helps?

- Customer Service: Is the company easy to contact?

- Company Reputation: Do they have good reviews?

Benefits of Full Coverage Auto Insurance

Full coverage offers many benefits:

- Peace of Mind: You know you are protected.

- Financial Safety: Helps with repair and medical costs.

- Legal Protection: Covers you if you are sued.

- Wide Coverage: Protects against many types of damage.

- Rental Car Coverage: Pays for a rental if your car is in the shop.

Understanding Insurance Terms

Insurance has many terms. Here are some to know:

| Term | Meaning |

|---|---|

| Premium | The amount you pay for insurance. |

| Deductible | The amount you pay before insurance helps. |

| Claim | A request for payment from your insurance. |

| Policy | The contract you have with the insurance company. |

Tips for Saving Money on Full Coverage

Full coverage can be expensive. Here are some tips to save money:

- Look for discounts. Many companies offer them.

- Bundle your insurance. Get car and home insurance together.

- Choose a higher deductible. This can lower your premium.

- Maintain a good driving record. Safe drivers pay less.

- Ask about payment options. Paying yearly might save money.

Frequently Asked Questions

What Is Full Coverage Auto Insurance?

Full coverage auto insurance includes liability, collision, and comprehensive coverages. It protects against various types of damage and accidents.

How Do I Find Full Coverage Near Me?

Use online search tools or contact local agents. They can provide quotes and details for full coverage options in your area.

Is Full Coverage More Expensive?

Yes, full coverage typically costs more. It offers broader protection, covering both your car and others involved in accidents.

Do I Need Full Coverage For My Car?

If your car is financed or leased, lenders usually require full coverage. It’s also beneficial for newer or valuable vehicles.

Conclusion

Full coverage auto insurance is important. It protects you and your car. It helps you in case of accidents. It saves you money on repairs and medical bills.

Finding the right insurance takes time. Compare different options. Choose what fits your needs and budget.

Remember, the right insurance gives you peace of mind. It makes driving a safer experience for you and others.

Read More:

- Best Cities for Real Estate Investment: Top Picks 2025

- Real Estate Market Trends: Unlocking 2025 Insights

- Pedestrian Accident Attorney: Your Legal Advocate Today

- Housing Bubble: Uncovering the Next Big Market Shift

- Average Settlement for Personal Injury Claim: Maximize Your Payout

- How to File an Auto Insurance Claim: Expert Tips

- Best Car Insurance Companies 2025: Top Picks Revealed

- Construction Accident Lawyer: Your Path to Justice