Are you dreaming of owning your own home but unsure if it’s within your financial reach? The path to homeownership can be exciting yet daunting, especially when you’re trying to figure out how much house you can really afford.

This is where a Home Affordability Calculator becomes your best ally. Imagine having a tool that takes the guesswork out of your budget, providing you with a clear picture of your financial standing and helping you make informed decisions. By understanding exactly what you can afford, you can shop for homes with confidence and peace of mind.

Ready to unlock the secrets to smarter home buying? Dive into this article and discover how a Home Affordability Calculator can transform your home-buying experience.

What Is A Home Affordability Calculator?

Understanding how much house you can afford is crucial. A Home Affordability Calculator can help you with this. It provides a clear picture of your financial capabilities. This tool is essential before starting your home search. It considers several factors to give you an accurate estimate.

What Does A Home Affordability Calculator Do?

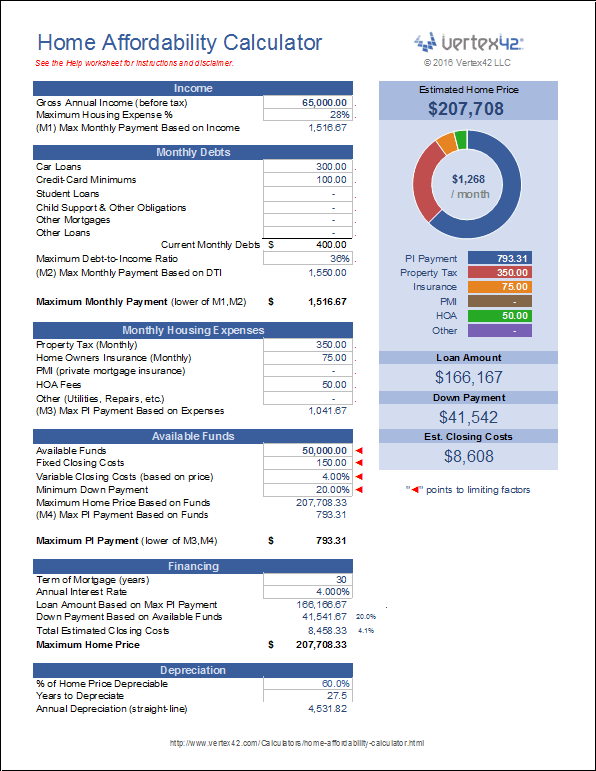

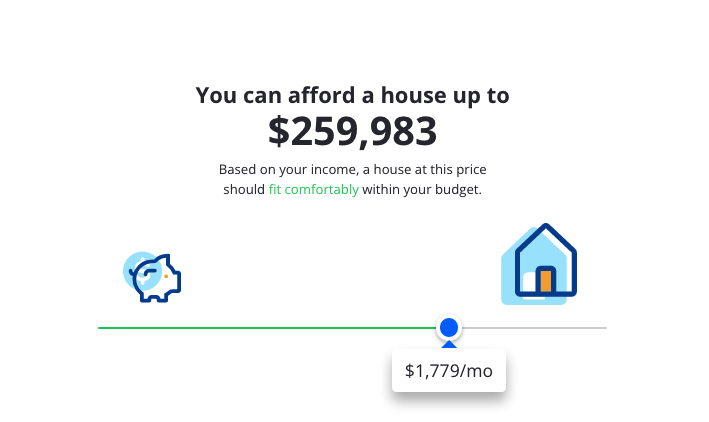

It calculates the maximum home price you can afford. This depends on your income, debts, and expenses. It helps you plan your budget efficiently. Using it can prevent future financial stress.

How Does A Home Affordability Calculator Work?

It asks for basic information like your income. You also provide details on debts and monthly expenses. The calculator uses this data to compute a safe price range. This ensures your mortgage payments fit your budget.

It saves time during your home search. You focus only on homes within your budget. It also prevents overspending on a house. This tool helps avoid financial burdens. It gives peace of mind knowing your limits.

Key Factors Considered By The Calculator

Your income and debts are primary factors. The calculator also considers loan interest rates. It includes property taxes and insurance costs. These elements affect your affordability. Understanding them ensures a realistic budget.

Why You Should Use A Home Affordability Calculator

It simplifies the home-buying process. You gain confidence in your financial decisions. It helps you avoid costly mistakes. Knowing your limits is empowering. This tool is a smart step in home purchasing.

Benefits Of Using A Home Affordability Calculator

Understanding how much home you can afford is crucial. A Home Affordability Calculator helps simplify this. It offers valuable insights into your financial situation. You can make informed decisions with ease.

Financial Clarity

The calculator provides clear financial insights. It breaks down your income, expenses, and debts. This helps you see what you can comfortably afford. You gain a better understanding of your budget. It helps identify areas where you can save more.

Avoiding Overcommitment

Many buyers overestimate their budget. This leads to financial stress. The calculator prevents this by setting realistic limits. You avoid buying a home that’s beyond your means. Staying within budget ensures financial stability.

Streamlined Home Search

Knowing your budget narrows your search. You focus on homes within your price range. This saves time and effort. You avoid considering homes you can’t afford. The search becomes less overwhelming and more efficient.

Key Factors In Home Affordability Calculations

Understanding home affordability is crucial for potential homeowners. Calculators help estimate how much house one can afford. Several key factors influence these calculations. Grasping them makes the home-buying process smoother.

Income Levels

Income plays a vital role in home affordability. Lenders assess earnings to decide loan amounts. A higher income often means more borrowing power. Stable and consistent income sources are important. Job stability can enhance borrowing capacity.

Debt Obligations

Existing debts impact home affordability. Lenders check debt-to-income ratios. A high ratio can limit loan amounts. Lowering debts can increase affordability. Credit card balances, car loans, and student loans matter. Managing debts wisely is beneficial.

Down Payment

The down payment affects how much you can afford. A larger down payment reduces loan amounts. It can also lower monthly payments. Saving for a substantial down payment is advisable. It might also lead to better loan terms.

Interest Rates

Interest rates influence monthly mortgage payments. Lower rates mean lower payments. They make homes more affordable. Rates fluctuate based on the economy. Keeping an eye on rate trends is wise. Locking in favorable rates can save money.

Property Taxes

Property taxes add to homeownership costs. They vary by location. Higher taxes can reduce affordability. Research local tax rates before buying. Understand how they affect overall costs. Factoring them in helps avoid surprises.

Steps To Use A Home Affordability Calculator

Buying a home is a major decision. A home affordability calculator helps you understand how much you can afford. Using the calculator involves a few simple steps. Follow these steps to ensure accurate results. This section breaks down the process into easy-to-follow parts. Let’s get started on using a home affordability calculator effectively.

Gather Financial Information

Start by collecting your financial details. Know your monthly income and expenses. List any debts or loans you have. Include your savings and investments. This data is crucial for accurate calculations. The calculator needs a clear picture of your finances. Gather everything before proceeding.

Input Relevant Data

Next, input your gathered financial information. Enter your monthly income into the calculator. Provide details about your expenses and debts. Don’t forget to add your savings. Ensure all data entered is correct. Accuracy is key for the best results. The calculator uses this data to estimate affordability.

Analyze Results

After entering your data, review the results. The calculator shows how much you can afford. Compare this with your budget and goals. This helps you make informed decisions. Adjust your plans based on the results. Understanding the results guides your next steps in home buying.

Common Mistakes To Avoid

Avoid overestimating income and underestimating expenses with home affordability calculators. Ensure accurate inputs for reliable results. Double-check calculations to prevent financial strain.

Navigating the world of home buying can be complex. Many rely on home affordability calculators. These tools help determine what you can afford. Yet, mistakes in using them are common. Avoiding these can save you stress and money. Let’s explore some pitfalls to steer clear of.Ignoring Hidden Costs

Many buyers focus only on the price of the house. They forget about hidden costs. These include property taxes, insurance, and maintenance. Closing costs can also surprise many. Ignoring these can lead to financial strain. Always factor them into your calculations.Overestimating Income

Some buyers misjudge their income. They might include bonuses or irregular earnings. This can give a false sense of security. It’s safer to calculate using your regular income. This ensures you won’t stretch your budget too thin.Underestimating Expenses

It’s easy to overlook daily expenses. Groceries, utilities, and transportation costs add up. Failing to account for these can affect your budget. Make a comprehensive list of monthly expenses. This gives a clearer picture of what you can truly afford. Avoid these errors for a smoother home-buying journey.Enhancing Accuracy Of Calculations

Understanding the nuances of home affordability can be challenging. Ensuring precise calculations is crucial for making informed financial decisions. A Home Affordability Calculator helps estimate what you can afford. Enhancing the accuracy of these calculations involves several important practices.

Regular Financial Reviews

Regularly review your finances for changes. Income, expenses, and debts can fluctuate. A small shift can impact your home affordability. Keep track of any adjustments. Use updated figures in your calculations. This practice maintains accuracy.

Consulting Financial Advisors

Consulting financial advisors can offer valuable insights. They understand market trends and financial strategies. Advisors can guide you through complex financial scenarios. Their expertise ensures more precise affordability calculations. They help in aligning financial goals with realistic outcomes.

Future Trends In Home Buying Tools

Home buying tools are evolving rapidly. Technology is playing a crucial role. These tools make the home buying process simpler and more efficient. As technology advances, these tools become more sophisticated. Buyers can expect improved accuracy and personalized insights. Let’s explore the future trends in home buying tools.

Integration With Ai

AI is changing the way we use home buying tools. It processes large amounts of data quickly. This helps in predicting property values and market trends. AI can analyze buying patterns and preferences. It provides more accurate price forecasts. Users get tailored information suited to their needs. AI makes the home buying process smarter and faster.

Personalized Recommendations

Personalized recommendations are becoming a norm. Home buying tools now adapt to individual preferences. Users receive suggestions based on their search history and preferences. This helps in narrowing down choices. Personalized tools save time and reduce stress. They help buyers find homes that truly match their needs. Buyers receive insights that are most relevant to them.

Frequently Asked Questions

What Is A Home Affordability Calculator?

A home affordability calculator estimates how much house you can afford. It considers your income, expenses, and debts. By inputting these details, you can determine a realistic home-buying budget. This tool helps avoid financial strain by aligning your home purchase with your financial situation.

How Does A Home Affordability Calculator Work?

It uses your financial information to calculate home affordability. You input your income, debt, and down payment. The calculator then estimates the maximum home price you can afford. This helps you understand your budget and make informed home-buying decisions.

Why Use A Home Affordability Calculator?

A home affordability calculator helps set realistic home-buying expectations. It prevents overextending your finances. By understanding your budget, you can focus on homes within your price range. This tool simplifies your home search and supports better financial planning.

Can A Calculator Predict All Home-buying Costs?

No, it estimates based on basic financial data. It doesn’t account for hidden costs like closing fees, maintenance, or property taxes. For a comprehensive view, consider consulting a financial advisor. They can provide a detailed analysis of all potential home-buying expenses.

Conclusion

A home affordability calculator helps you make smart choices. It guides you on your journey to owning a home. You understand your budget better. You see what you can really afford. It’s like having a map for your financial path.

Use it to avoid surprises. Plan your home-buying steps wisely. It gives peace of mind. You can focus on what’s important. Your dream home is closer than you think. Remember, careful planning is key. With this tool, home ownership becomes less stressful.

Start your journey today. Make informed decisions with confidence.