Getting into a car accident is scary. Filing an auto insurance claim can help you. It gets your car repaired. It covers costs.

What is an Auto Insurance Claim?

An auto insurance claim is a request. You ask your insurance for help. You need help to pay for damage. This can be car damage or injuries.

When to File an Auto Insurance Claim?

File a claim after an accident. Also, file if your car is stolen. Another time is if your car is damaged in a storm.

Steps to File an Auto Insurance Claim

Filing a claim has steps. Follow these steps to make it easy.

1. Stay Calm And Safe

After an accident, stay calm. Check if everyone is safe. Move away from traffic if you can. Safety is most important.

2. Call The Police

Call the police right away. They will make a report. This report is important for your claim. Tell them what happened.

3. Gather Information

Collect details at the scene. Get the other driver’s name and contact. Write down their insurance info. Take pictures of the damage. Capture the scene with your camera.

4. Contact Your Insurance Company

Call your insurance company soon. Tell them about the accident. Give them all the information you have. They will guide you on the next steps.

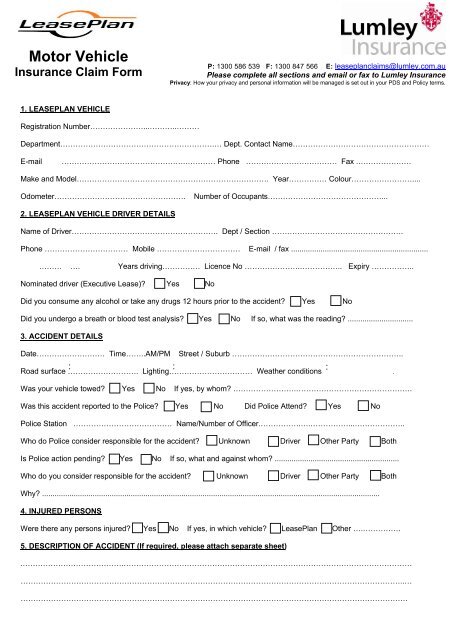

5. Fill Out The Claim Form

Your insurance company will send a form. Fill it out carefully. Include all the details. Be honest. Honesty helps your claim.

6. Work With The Adjuster

An adjuster will contact you. They check the damage. They decide how much the insurance will pay. Cooperate with them. Give them any extra information they need.

7. Get Your Car Repaired

Once approved, get your car fixed. The insurance will pay for it. Sometimes, you pay a small part. This part is called a deductible.

Tips to Make the Process Smooth

- Keep all documents. This includes pictures, police reports, and receipts.

- Stay in touch with your insurance company. Ask questions if you have any.

- Be patient. The process can take time.

Common Mistakes to Avoid

Some mistakes can slow down your claim. Avoid them to make things easy.

- Do not lie. Be truthful in your report.

- Do not sign anything without reading.

- Do not forget to take pictures. Pictures help your case.

What Happens After You File a Claim?

Your insurance company will review your claim. They check the information you give. They may ask for more details. They will then decide on your claim.

Understanding Deductibles

A deductible is what you pay before insurance helps. If you have a $500 deductible, you pay $500 first. Then, insurance pays the rest.

Why Filing a Claim is Important?

Filing a claim helps you get your car fixed. It helps with medical bills if needed. Insurance is there to protect you.

When Not to File a Claim

Sometimes, you may not need to file. If damage is less than your deductible, paying yourself might be better. Consider the cost before deciding.

Frequently Asked Questions

What Documents Do You Need To File A Claim?

You need your insurance policy details, accident report, and photos of damage. Simple and straightforward.

How Long Does A Claim Process Take?

It varies. Typically, it takes a few days to weeks. Quick and efficient.

Can You File A Claim Online?

Yes, most insurance companies offer online claim filing. Convenient and hassle-free.

What Happens After You File A Claim?

The insurer reviews and assesses damages. Then, they provide compensation. Smooth and methodical.

Conclusion

Filing an auto insurance claim is simple with these steps. Stay calm, gather information, and work with your insurer. Your car will be back on the road soon.

Read More:

- Best Cities for Real Estate Investment: Top Picks 2025

- Real Estate Market Trends: Unlocking 2025 Insights

- Pedestrian Accident Attorney: Your Legal Advocate Today

- Housing Bubble: Uncovering the Next Big Market Shift

- Average Settlement for Personal Injury Claim: Maximize Your Payout

- Full Coverage Auto Insurance near Me: Find the Best Deals

- Best Car Insurance Companies 2025: Top Picks Revealed

- Construction Accident Lawyer: Your Path to Justice