Insurance helps when things go wrong. It gives money to fix problems. But getting the most money is not easy. Here, we will learn how to do it.

Understand Your Insurance Policy

Your insurance policy is a contract. It tells what is covered. It also shows what is not covered. Read it carefully. Know what your policy says. If you do not understand, ask questions. Ask your insurance agent for help. They can explain it to you.

Know The Terms

Policies have special words. These words are important. Here are some you should know:

- Premium: This is the money you pay for insurance.

- Deductible: This is the money you pay when you make a claim. The insurance pays the rest.

- Coverage Limit: This is the most money the insurance will pay.

Understanding these terms helps you in claims. You will know what to expect.

Document Everything

Good records help with claims. Keep all papers safe. Take pictures if something breaks. Write down what happened. The more information you have, the better.

Take Photos And Videos

Photos and videos are proof. They show what happened. Take them from different angles. More proof means a better chance of a good payout.

Keep Receipts

Receipts show what you paid. They are proof of value. Insurance companies like proof. It makes the process easier.

Report the Claim Quickly

Time is important in claims. Report as soon as you can. Call your insurance company. Tell them what happened. The faster you report, the faster they can help.

Some companies have time limits. If you wait too long, you may not get money. Always check your policy for time limits.

Be Honest and Clear

Always tell the truth. Be clear in your report. Do not hide anything. Honesty helps the process. It also builds trust with your insurance company.

If you are not sure about something, ask. Your insurance company can help explain.

Work with the Adjuster

An adjuster looks at your claim. They decide how much the insurance will pay. Be polite and helpful. Give them all the information they need. This helps them do their job well.

Meet With The Adjuster

Set a time to meet. Show them the damage. Give them your documents. Answer their questions. Cooperation is key. It helps get a fair payout.

Know Your Rights

As a policyholder, you have rights. Know them. If you feel your claim is unfair, you can ask for help. Some places have help centers. They can guide you.

Negotiate if Necessary

If the payout is too low, you can negotiate. Explain why you think it should be more. Use your documents to support your case. Be calm and polite.

Sometimes, getting help from a professional can be useful. They know how to handle claims. They can help you get a fair payout.

Review and Double Check

Before you accept the money, check everything. Make sure it covers what you need. If you find mistakes, tell your insurance company. They can fix it.

Keep Communication Open

Stay in touch with your insurance company. Ask for updates. Tell them if something changes. Good communication helps the process.

Frequently Asked Questions

How Can I Increase My Insurance Claim Payout?

Document all damages thoroughly. Provide detailed evidence. This can strengthen your case and maximize your payout.

What Should I Avoid During The Claims Process?

Avoid exaggerating claims. Always be truthful. Misrepresentation can lead to denial or reduced payouts.

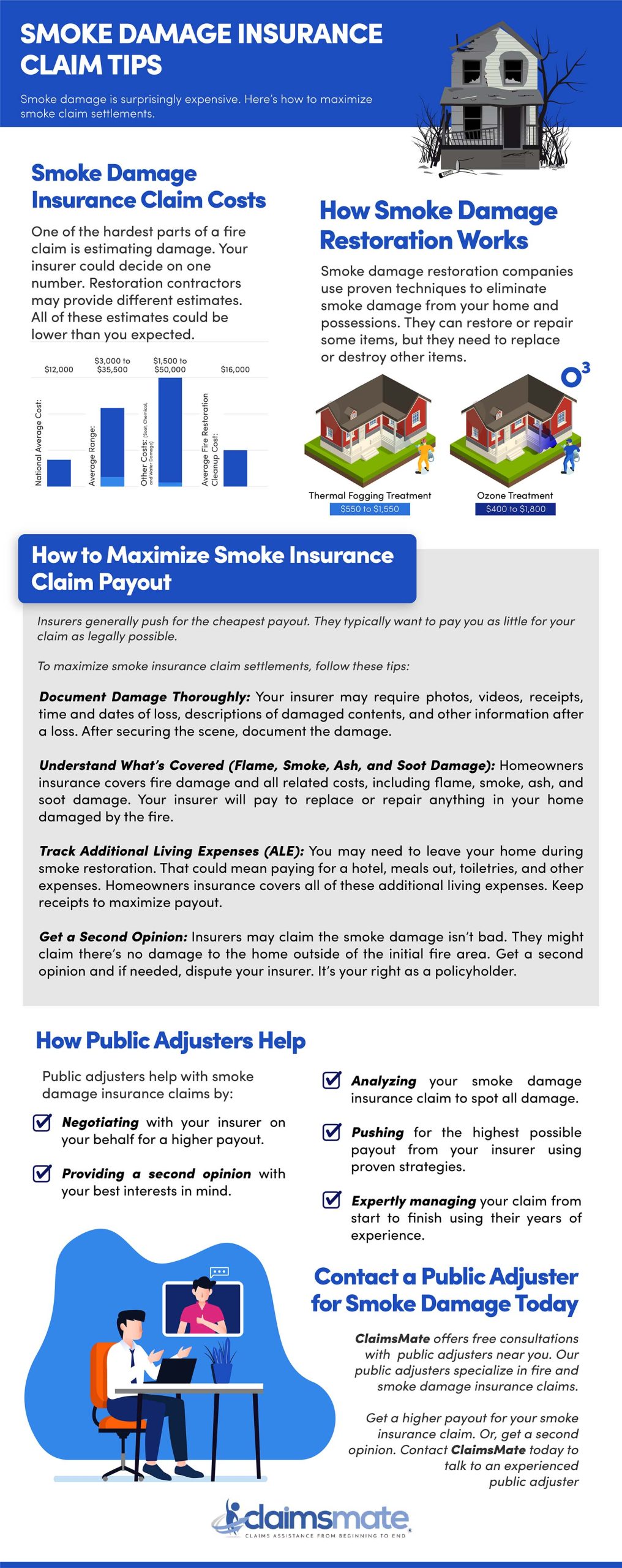

Is It Helpful To Hire A Public Adjuster?

Yes, a public adjuster can help. They negotiate with insurers, potentially increasing your payout.

How Does Policy Coverage Affect Claim Payouts?

Coverage limits define payout amounts. Understand your policy to ensure you claim accurately within its terms.

Conclusion

Getting a good payout takes work. Understand your policy. Keep good records. Be honest and clear. Work with your adjuster. Know your rights. These steps help you get a fair payout. Insurance is there to help. Use it wisely.