Mortgage rates play a crucial role in shaping your financial future. Whether you’re a first-time homebuyer or looking to refinance, understanding mortgage rates can save you thousands of dollars.

Imagine having a clear path to owning your dream home without the stress of unpredictable costs. With just a little insight, you can make decisions that align perfectly with your financial goals. This guide will help you navigate the complexities of mortgage rates, making the process less daunting and more rewarding.

Stick around to discover how you can take control of your mortgage journey and secure the best possible rates for your situation.

:max_bytes(150000):strip_icc()/BgXcd-average-mortgage-rates-over-the-last-year-feb-29-2024-0875eb9980bb4ece94169bb78b670b86.png)

Understanding Mortgage Rates

Understanding mortgage rates is crucial for home buyers. These rates dictate how much interest you’ll pay on your loan. They affect your monthly payments and overall loan costs. Knowing them helps you make informed financial decisions.

Factors Influencing Rates

Several factors impact mortgage rates. Economic conditions play a major role. A strong economy can lead to higher rates. Inflation also affects rates. When inflation rises, rates may increase. Central banks set interest rates too. These decisions trickle down to mortgage rates. Your credit score influences what rate you get. A higher score might mean a lower rate. Property location can also change rates. Each region has different lending conditions.

Fixed Vs. Variable Rates

Fixed rates stay the same over the loan term. They offer stability and predictable payments. You know what you’ll pay each month. Variable rates can change over time. These rates depend on market conditions. They might start low and rise later. Variable rates can be risky but offer initial savings. Choosing between them depends on your comfort with risk. Some prefer the security of fixed rates. Others might gamble on variable rates for potential savings.

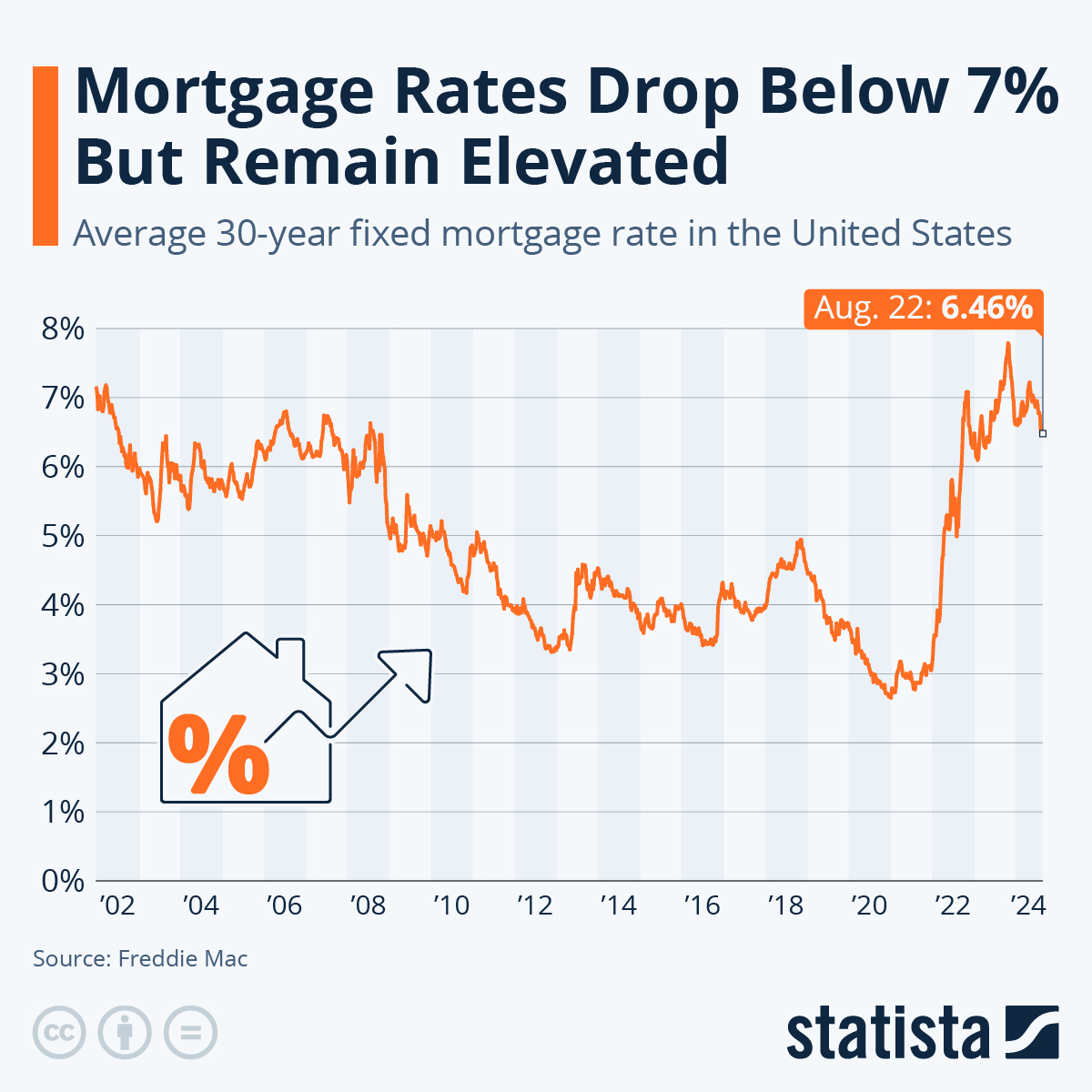

Current Market Trends

Mortgage rates fluctuate based on several market trends. Understanding these trends can help potential homebuyers make informed decisions. The economy’s health, inflation levels, and other factors influence these rates. Let’s delve into the current market trends affecting mortgage rates today.

Economic Indicators

Economic indicators play a crucial role in determining mortgage rates. The employment rate is a significant indicator. A high employment rate often leads to higher mortgage rates. This is because a strong job market boosts the economy. Gross Domestic Product (GDP) also impacts mortgage rates. A growing GDP signals a healthy economy. Lenders may then raise mortgage rates.

Consumer spending is another key indicator. Increased spending suggests economic growth. It can lead to higher interest rates. Monitoring these indicators helps predict mortgage rate trends.

Impact Of Inflation

Inflation has a direct effect on mortgage rates. As inflation rises, so do interest rates. Lenders increase rates to maintain their profit margins. High inflation means the cost of goods and services increases. This forces lenders to adjust rates accordingly.

Central banks manage inflation by altering interest rates. To curb inflation, they might raise rates. This, in turn, affects mortgage rates. Homebuyers need to be aware of inflation trends. It helps them understand potential rate changes.

How To Compare Lenders

Finding the best mortgage rates requires comparing lenders. Check interest rates, fees, and terms. Ask questions. Make informed decisions.

Finding the right mortgage lender is crucial in securing a home loan that fits your needs. The process can feel overwhelming, but comparing lenders effectively can save you a lot of money. So, how do you cut through the noise and find the best option? It starts with evaluating interest rates and assessing fees and charges. Let’s break it down.Evaluating Interest Rates

Interest rates are often the first thing people look at when choosing a lender. However, a lower rate is not always the best deal. It’s important to compare the Annual Percentage Rate (APR) from multiple lenders, as it includes both the interest rate and any additional costs. Consider the type of interest rate you prefer—fixed or variable. A fixed rate offers stability, while a variable rate might start lower but can increase over time. Does the thought of fluctuating payments make you uneasy? If so, a fixed rate might be your best bet. Don’t forget to check if the lender offers rate locks. This can protect you from rising rates during the loan process. Rate locks can be a game-changer if interest rates are volatile.Assessing Fees And Charges

Lenders often have a variety of fees that can add up quickly. Origination fees, application fees, and closing costs are common. Make sure to ask each lender for a breakdown of these costs. A table can be helpful to compare fees side by side:| Lender | Origination Fee | Application Fee | Closing Costs |

|---|---|---|---|

| Lender A | $1,500 | $500 | $3,000 |

| Lender B | $1,200 | $0 | $2,800 |

Tips For Securing Low Rates

Securing a low mortgage rate can save you money over time. It makes your home purchase more affordable. But how do you secure a low rate? Here are some actionable tips. They can help you navigate this process with confidence.

Improving Credit Score

Your credit score affects your mortgage rate. A higher score can mean lower rates. Start by checking your credit report. Look for errors and dispute them. Pay your bills on time. Reduce your debt-to-income ratio. Use less than 30% of your credit limit. These actions can boost your score. Better scores can lead to better rates.

Timing Your Purchase

Market conditions impact mortgage rates. Rates can vary throughout the year. Research trends to find the best time to buy. Spring and summer often have higher rates. More people are buying during these times. Winter may offer lower rates. Fewer people are in the market. Check with lenders for current rate trends. Being informed helps you make smart decisions.

The Role Of Mortgage Brokers

Mortgage brokers help find competitive mortgage rates by connecting borrowers with lenders. They simplify the process and offer tailored options. Brokers negotiate terms that suit financial needs, ensuring you get the best possible deal.

Navigating the world of mortgage rates can feel like walking through a maze. Many potential homeowners might find themselves overwhelmed by the myriad of options. This is where mortgage brokers step in to guide you through the process. They act as intermediaries between you and potential lenders, helping you find the best possible deals based on your financial situation.Benefits Of Using Brokers

Mortgage brokers can be your allies in the complex world of home loans. They have access to a wide network of lenders, which means more choices for you. With their expertise, they can often secure better rates than you might find on your own. Brokers save you time. Instead of researching dozens of lenders, you can focus on what’s important to you. They handle the legwork, from paperwork to communication, streamlining the mortgage process. Imagine you’re shopping for a new phone. Would you prefer visiting multiple stores, or having someone show you the best options at once? That’s the convenience a broker provides. They simplify the overwhelming choices, so you can make informed decisions with ease.Questions To Ask Brokers

To ensure you’re getting the best service, ask your broker some key questions. How many lenders do you work with? This will give you an idea of the range of options they can offer. What are the fees involved? Transparency is crucial, and understanding the cost structure helps you avoid surprises. Are there any potential hidden costs? Directly addressing this can save you from unexpected expenses down the road. Have you worked with clients in my financial situation before? This question helps gauge their experience and ability to tailor solutions to your needs. Think about how you want your mortgage journey to unfold. Are you comfortable with the choices before you? Your broker should empower you, not just sell you a product. Engaging with a mortgage broker could be the key to turning your homeownership dreams into reality. By leveraging their expertise, you can navigate the mortgage landscape with confidence and clarity.

Government Programs And Incentives

Buying a home can be challenging. Government programs and incentives can help. These programs make home buying more affordable. They also offer benefits for refinancing.

First-time Buyer Programs

First-time buyers have unique opportunities. Several programs aim to assist them. The FHA loan is popular. It requires a lower down payment. The USDA loan is another option. It supports rural home purchases. VA loans benefit veterans and their families. They often require no down payment.

Refinancing Options

Refinancing can reduce mortgage costs. The HARP program helps homeowners refinance. It’s available to those with little equity. FHA streamline refinancing is another choice. It offers easier qualification and less paperwork. VA interest rate reduction loans are available too. They lower rates for veterans.

Common Mistakes To Avoid

Understanding mortgage rates can be confusing. Many make mistakes when choosing a mortgage. These mistakes can cost money and cause stress. Avoiding common errors ensures a smoother process.

Ignoring Hidden Costs

Hidden costs can surprise many homeowners. Fees like closing costs add to total expenses. Some lenders charge for application or processing fees. Not knowing these costs leads to unexpected bills. Always ask for a detailed fee breakdown. Understanding all charges helps prevent surprise expenses.

Overlooking Loan Terms

Loan terms affect monthly payments and interest rates. Short-term loans often have higher payments. Long-term loans may have lower monthly costs but higher interest over time. Understand the loan length and interest type. Fixed rates stay the same, but variable rates change. Knowing these details helps in choosing the right mortgage plan.

Frequently Asked Questions

What Affects Mortgage Rates Today?

Mortgage rates are influenced by economic factors like inflation, employment levels, and the Federal Reserve’s policies. Lender competition and market demand also play a role. Your credit score and loan amount further impact the rate you receive. Staying informed about these factors can help you secure favorable mortgage terms.

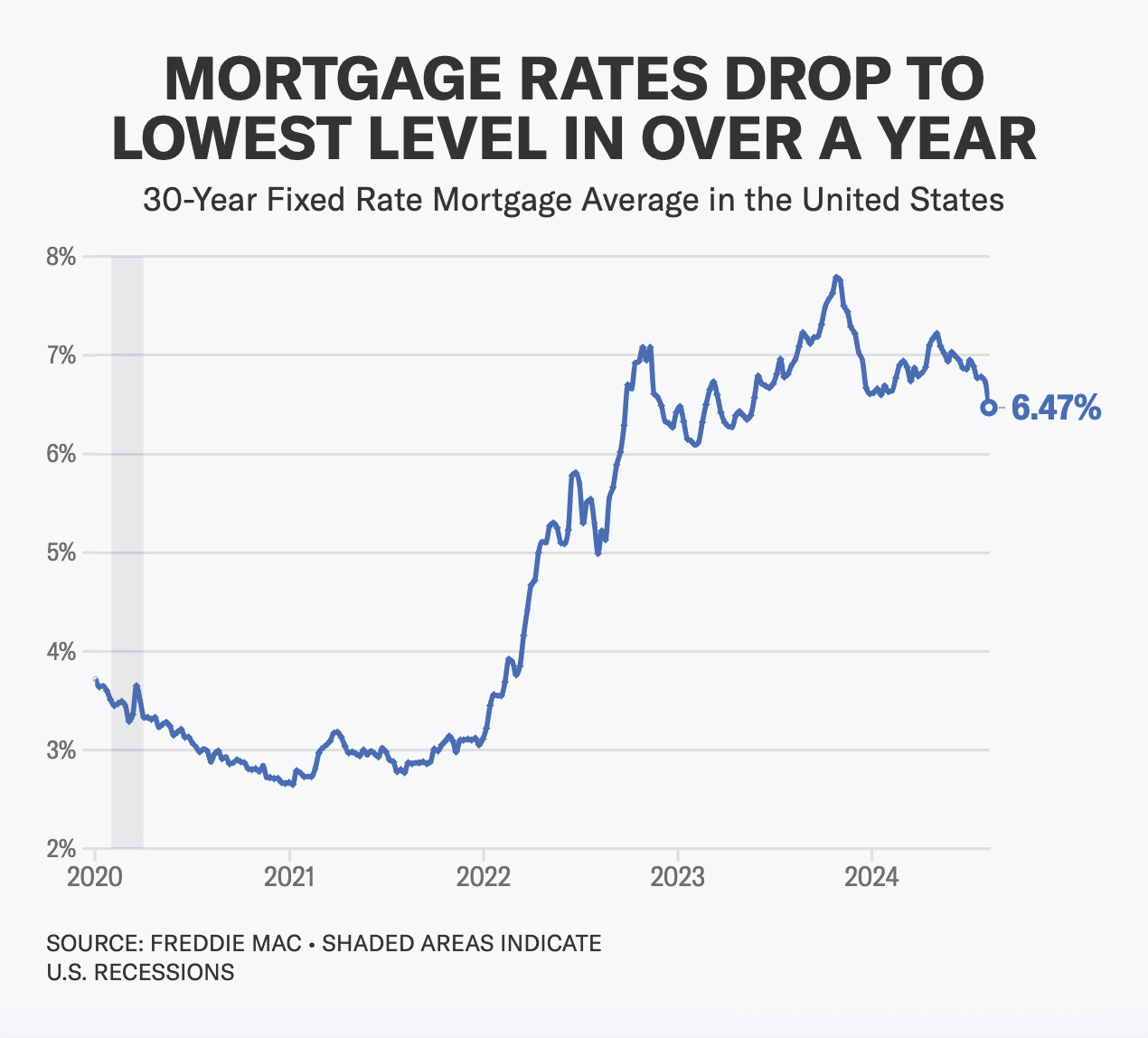

How Often Do Mortgage Rates Change?

Mortgage rates can change daily due to economic fluctuations and market conditions. Lenders adjust rates based on bond market changes and economic forecasts. Monitoring rates regularly can help you lock in a good deal. Being proactive and informed is key to navigating these fluctuations effectively.

Are Fixed Or Variable Mortgage Rates Better?

Fixed rates offer stability with unchanging monthly payments, ideal for long-term plans. Variable rates may start lower but can fluctuate, suitable for short-term stays. Consider your financial goals and risk tolerance when choosing between the two. Consulting with a financial advisor can provide personalized guidance.

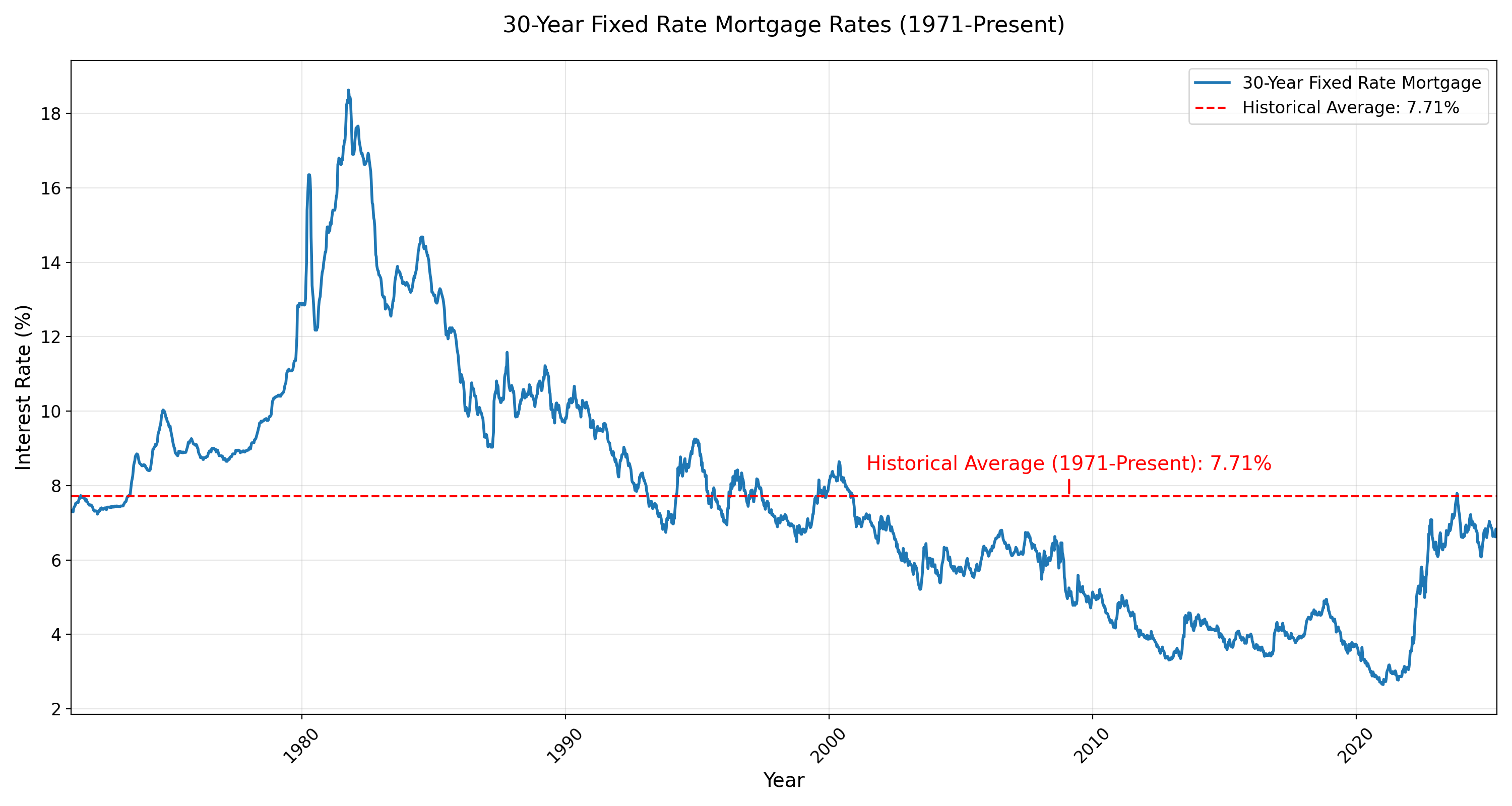

Why Are Mortgage Rates Rising?

Mortgage rates rise due to inflation, economic growth, and Federal Reserve policies. When the economy strengthens, rates typically increase to curb inflation. External factors like global events and government regulations also influence rates. Understanding these elements can help you make informed decisions about your mortgage.

Conclusion

Mortgage rates change over time. They affect your monthly payments. Staying informed helps you make smart choices. Compare rates from different lenders. Check your credit score regularly. A better score may offer better rates. Consult with a mortgage advisor. They provide valuable insights.

Planning ahead can save money. Budgeting wisely is crucial. Consider long-term financial goals. Make sure your home investment fits them. Stay patient during the process. The right choice leads to future stability. Remember, a good mortgage rate helps secure your financial future.

Keep learning about rates and stay proactive in managing your mortgage.